Excitement About G. Halsey Wickser, Loan Agent

Table of ContentsA Biased View of G. Halsey Wickser, Loan AgentThe Best Guide To G. Halsey Wickser, Loan AgentG. Halsey Wickser, Loan Agent Things To Know Before You Get ThisA Biased View of G. Halsey Wickser, Loan AgentThings about G. Halsey Wickser, Loan Agent

The Support from a home mortgage broker doesn't end as soon as your home loan is safeguarded. They offer recurring assistance, helping you with any questions or issues that emerge during the life of your car loan - california mortgage brokers. This follow-up assistance ensures that you continue to be satisfied with your home loan and can make enlightened decisions if your financial situation changesDue to the fact that they collaborate with multiple loan providers, brokers can discover a lending product that suits your one-of-a-kind monetary situation, also if you have been refused by a financial institution. This flexibility can be the secret to opening your dream of homeownership. Selecting to deal with a home loan advisor can transform your home-buying journey, making it smoother, much faster, and a lot more economically beneficial.

Finding the right home for on your own and identifying your spending plan can be very demanding, time, and money-consuming - mortgage broker in california. It asks a great deal from you, depleting your power as this task can be a task. (https://pastebin.com/u/halseyloanagt) A person that acts as an intermediary in between a consumer a person seeking a home loan or mortgage and a lending institution normally a financial institution or lending institution

A Biased View of G. Halsey Wickser, Loan Agent

Their high level of experience to the table, which can be critical in helping you make notified choices and eventually attain successful home funding. With rate of interest prices changing and the ever-evolving market, having a person fully tuned in to its ongoings would certainly make your mortgage-seeking procedure a lot easier, eliminating you from navigating the battles of filling out documents and executing loads of study.

This lets them offer expert guidance on the very best time to protect a mortgage. Because of their experience, they likewise have actually developed links with a vast network of loan providers, varying from major banks to customized mortgage carriers. This comprehensive network enables them to offer property buyers with various home mortgage choices. They can take advantage of their partnerships to discover the most effective lenders for their customers.

With their market knowledge and capability to negotiate efficiently, mortgage brokers play a pivotal role in securing the most effective home mortgage deals for their customers. By keeping connections with a diverse network of loan providers, home loan brokers get to several mortgage alternatives. Their enhanced experience, described above, can give vital details.

See This Report on G. Halsey Wickser, Loan Agent

They possess the abilities and strategies to persuade loan providers to provide much better terms. This might consist of lower rate of interest, minimized closing costs, or also more flexible settlement schedules (mortgage loan officer california). A well-prepared mortgage broker can offer your application and financial profile in a manner that charms to loan providers, boosting your chances of an effective arrangement

This advantage is typically a pleasant surprise for many homebuyers, as it enables them to take advantage of the knowledge and resources of a home mortgage broker without stressing over sustaining added expenditures. When a consumer safeguards a home loan through a broker, the lender compensates the broker with a commission. This commission is a percentage of the finance amount and is commonly based on factors such as the rates of interest and the kind of financing.

:max_bytes(150000):strip_icc()/dotdash-090915-mortgage-broker-vs-direct-lenders-which-best-Final-c7e52f06ff4f41bca0744429ee1838e3.jpg)

Mortgage brokers master recognizing these differences and functioning with lenders to discover a mortgage that fits each borrower's certain demands. This tailored technique can make all the difference in your home-buying trip. By functioning closely with you, your mortgage broker can ensure that your lending terms and problems line up with your financial objectives and capacities.

The smart Trick of G. Halsey Wickser, Loan Agent That Nobody is Discussing

Tailored home mortgage services are the secret to an effective and lasting homeownership experience, and mortgage brokers are the professionals who can make it take place. Employing a home loan broker to function together with you might cause rapid financing authorizations. By utilizing their expertise in this field, brokers can assist you stay clear of possible risks that usually create delays in funding approval, bring about a quicker and more effective path to protecting your home financing.

When it concerns acquiring a home, browsing the globe of home mortgages can be overwhelming. With a lot of alternatives readily available, it can be challenging to locate the right finance for your demands. This is where a can be a valuable source. Home loan brokers act as middlemans in between you and possible loan providers, aiding you locate the very best home mortgage bargain customized to your specific scenario.

Brokers are skilled in the complexities of the home mortgage sector and can supply valuable understandings that can assist you make informed decisions. As opposed to being restricted to the mortgage items supplied by a solitary lender, mortgage brokers have accessibility to a broad network of lending institutions. This indicates they can look around on your behalf to locate the most effective financing options offered, potentially conserving you time and money.

This accessibility to numerous lending institutions gives you a competitive benefit when it involves securing a beneficial home mortgage. Searching for the right mortgage can be a lengthy procedure. By dealing with a home loan broker, you can save time and effort by letting them handle the research and documentation included in searching for and safeguarding a loan.

Rumored Buzz on G. Halsey Wickser, Loan Agent

Unlike a small business loan policeman that might be handling several clients, a home mortgage broker can supply you with personalized service tailored to your private requirements. They can make the effort to understand your economic situation and objectives, supplying customized remedies that align with your certain demands. Home mortgage brokers are skilled negotiators that can help you protect the most effective feasible terms on your financing.

Heath Ledger Then & Now!

Heath Ledger Then & Now! Jennifer Love Hewitt Then & Now!

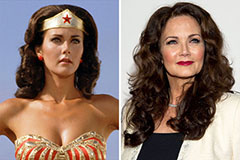

Jennifer Love Hewitt Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Traci Lords Then & Now!

Traci Lords Then & Now! Tina Louise Then & Now!

Tina Louise Then & Now!